Cash Flow Forecasting for Startups

A Startup Guide for Runway Clarity

YC says, “Most companies don't die because they run out of money”. That’s not quite true.

In reality, 29% of startups fail because they run out of cash before reaching product-market fit. Most don’t shut down due to lack of vision or grit, but because they lose sight of their cash.

The Real Cost of Not Forecasting Your Cash Flow

A startup I know needed a senior backend engineer to scale their product. They filled the gap with three mid-level hires instead of one senior engineer, burning millions over 18 months and never reaching product-market fit. A simple forecast tied to product milestones could have shown the real cost of compromising.

I’ve seen this play out more than once: founders budget for mid-level hires when the roadmap demands senior talent. Without forecasting, it looks like you’re saving money. In reality, you burn more runway and delay PMF.

And hiring isn’t the only risk. Miss your next fundraise by two months and you’re making layoffs. Hire too fast and your burn spikes. Hire too slow and you miss your GTM window. These moments are avoidable if you can see them coming.

What Exactly Is a Cash Flow Forecast?

A cash flow forecast isn’t just a monthly or yearly budget you make for your company

It’s your financial crystal ball. A forecast shows how money enters and exits your business over time. And most importantly, it shows whether you’ll make it to your next milestone before the tank hits zero.

Forecast vs budget vs accounting

- Forecast: Where you’re heading

- Budget: What you planned

- Accounting: What actually happened You need all three, but only one helps you make decisions in real time.

Your 30-Minute Forecasting Workshop

Here’s how to build a simple forecast in under half an hour.

Step 1: Inflows

What money is expected to come in?

- Funding or investments (equity, SAFEs, convertible notes)

- Revenue (subscriptions, sales, services)

- Grants, tax credits, subsidies

- Other inflows (refunds, deposits returned, interest income)

Step 2: Outflows

Track what leaves your account:

- Fixed costs: Salaries, software, rent, insurance

- Variable costs: Marketing, contractors, travel, equipment

Step 3: Hidden drains

Don’t overlook the sneaky ones:

- Annual renewals, tax bills, payment fees

- Currency losses, unused subscriptions

- Unexpected legal or compliance costs

Step 4: Identify Levers

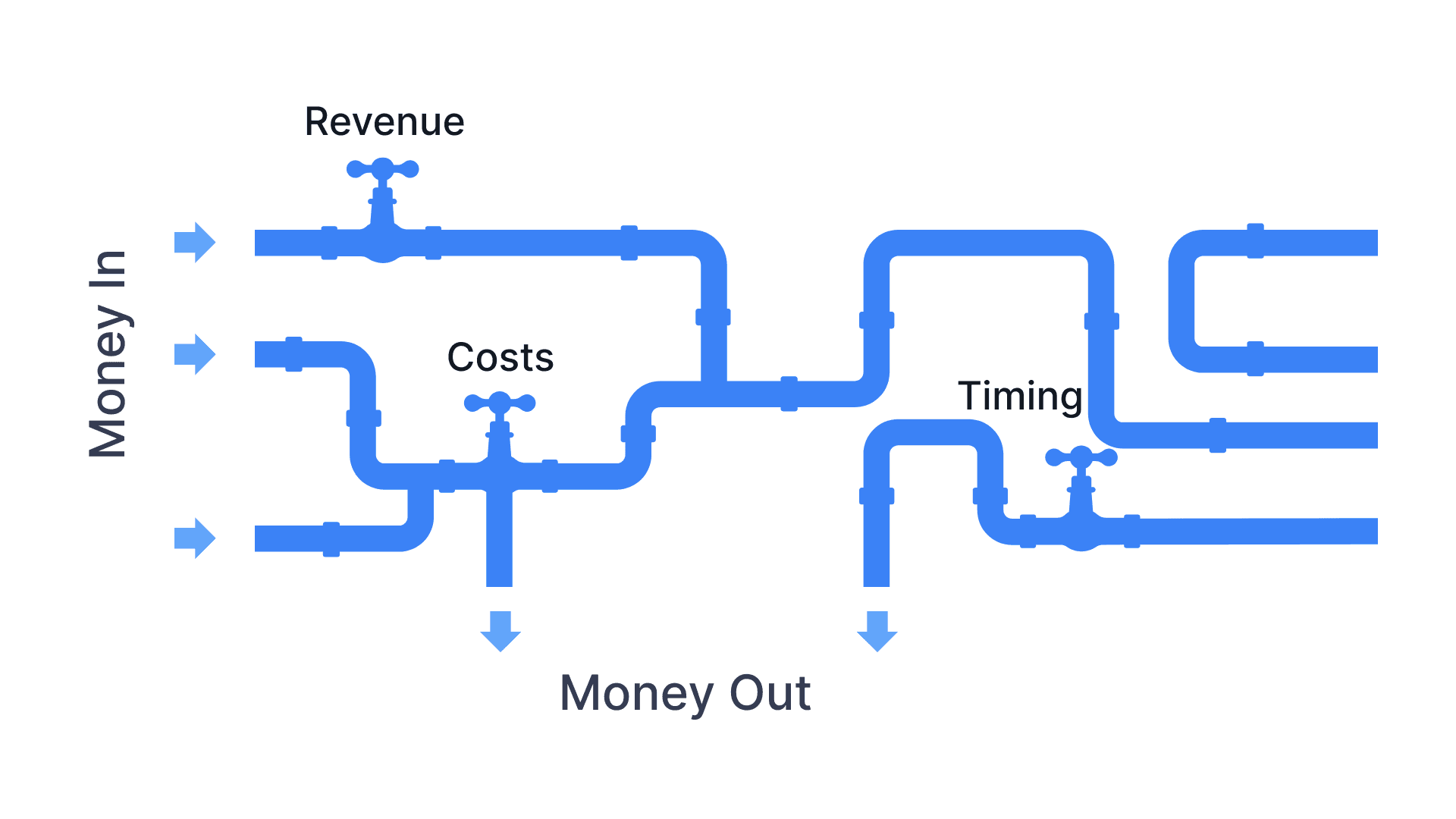

Once you’ve mapped your inflows and outflows, you’ve drawn the plumbing of your startup’s cash flow.

The next step is figuring out which taps you can actually adjust. These are your levers:

- Revenue levers: Sales conversion rates, customer churn, average deal size, payment timing.

- Cost levers:

- Fixed ( harder to change): office, insurance, software subscriptions.

- Variable (flexible): marketing spend, hiring pace, contractors, travel/events.

- Timing levers: When cash comes in (funding, customer payments) vs. when it goes out (payroll, large invoices)

Tweaking these levers lets you model how different decisions change your runway.

Step 5: Run scenarios and test your numbers

Now put your levers to work. Forecasting is about seeing how your cashflow shifts under different conditions and prepare for them.

- Worst Case: growth stalls, churn rises, funding delays, costs stay high longer than planned.

- Best Case: growth outperforms, customers pay faster, marketing ROI is high, maybe grants land early.

- Most Likely: conservative but realistic assumptions based on your sales pipeline and data. A plan you can defend to your board or investors.

The trick is not to tweak every number. Focus on the levers that actually move the needle:

- Revenue growth rate

- Hiring pace (salary burn)

- Marketing efficiency

- Timing of inflows/outflows

Once you’ve mapped best, worst, and most-likely cases, your forecast is no longer just numbers. It’s a map you can use to make smarter decisions

From Numbers to Strategy: Let Your Forecast Guide Decisions

Forecasting is useful only if it drives choices. Once you see how your numbers play out across scenarios, the value is in acting on them. Here are a few examples founders actually face:

- Runway is shorter than expected. Push back non-essential hires, renegotiate software contracts, or shift contractor work to in-house to extend cash.

- Cash inflows are delayed by slow customer payments. Introduce upfront billing, discounts for annual prepay, or stricter payment terms to smooth cash cycles.

- Growth is ahead of plan. If burn is still controlled, this is when to scale paid ads or bring in senior hires sooner.

- Revenue is below plan and CAC is already high. Instead of pouring more money into ads, it may be smarter to hire a strong sales rep who can close more deals from your existing pipeline.

- Next fundraise is 6–9 months away. A forecast lets you see if your current runway bridges to the raise. If not, plan a bridge round or cut discretionary spend now.

Forecasting should give you the clarity to act instead of reacting under pressure. When you use your forecast as a guide, you stop guessing and start steering your company with confidence.

Want to get forecasting right? Join CapitalSnapshot’s early beta

We’re building a better and faster way to help founders like you see where you stand, and where you’re heading.

→ Join our beta for easy forecasting where you just plug in your bank accounts and we do the forecasting for you.

About the author

Generalist with 12 years of experience in Tech startups in different roles like Solutions engineering, Developer Relations and a stint as a VC.