Financial Reporting for Startups: Your Investor Report Template

If you’re a funded startup founder, chances are you’ve been told to “keep your investors updated.” But what exactly does that mean? A monthly or quarterly email? A spreadsheet? A PDF?

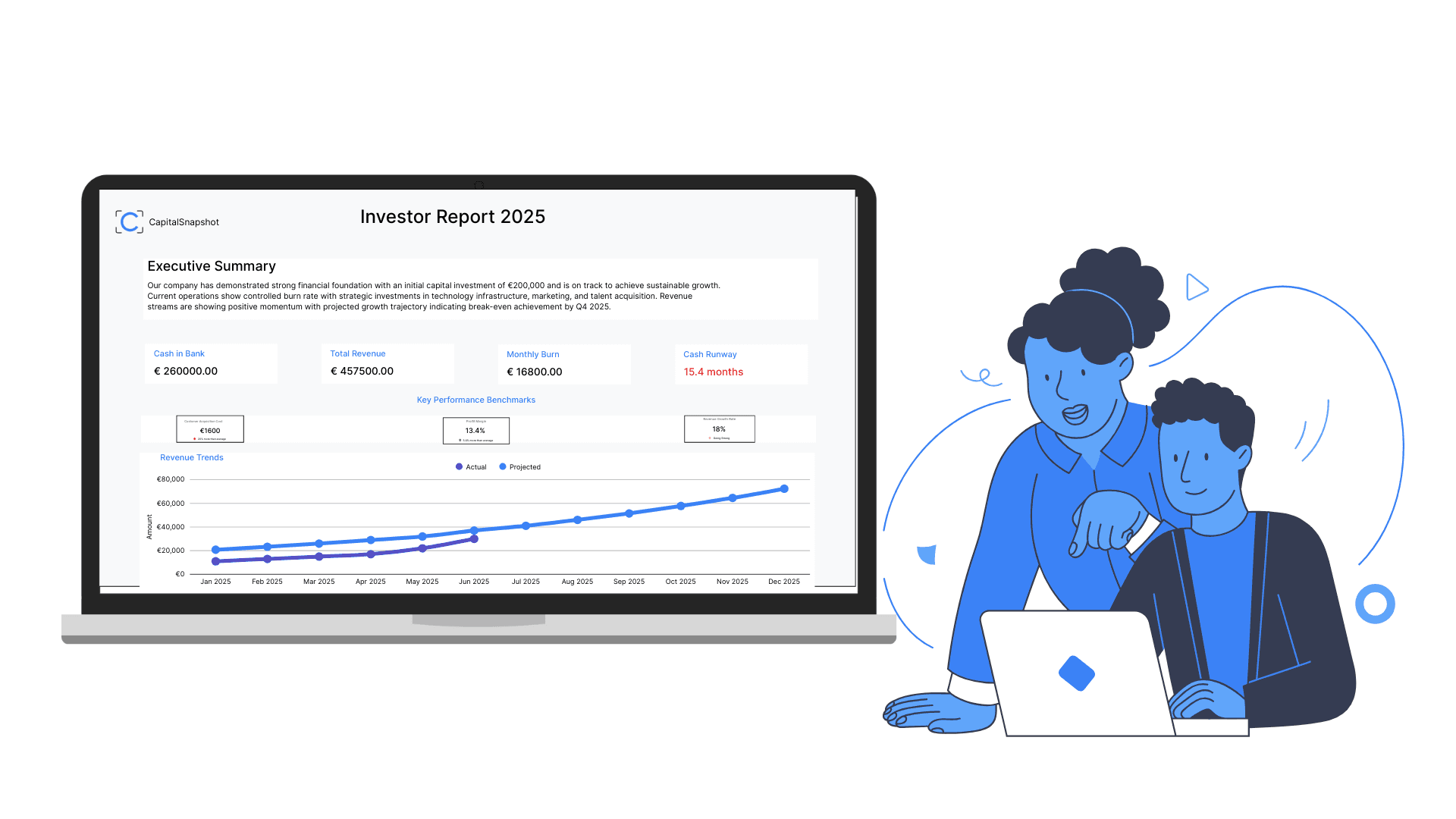

Let’s break down what investors actually look for in a VC report from startups, what to include in your reports, and how to get started without spending hours lost in spreadsheets.

Why Financial Reporting Matters to Investors

For most investors, financial reporting is one of the clearest indicators that you’re running your company with clarity and discipline. Consistent reporting builds credibility. Whether or not your numbers are perfect, showing up on time with clear data and context signals that you understand what is going on financially and you’re in control.

What do investors expect in a monthly or quarterly reports?

Your financial report is a lens into your company’s health. A good report helps investors:

- See if you’re tracking against plan/ forecast

- Flag issues early (burn too high, revenue flatlining)

- Understand how your business is evolving

This helps them manage their entire portfolio. They’re trying to spot the next unicorn, protect companies at risk, and plan future investments. Your report is part of that system.

Think Financial Reports Are Just for VCs? Think Again.

Clear financial reporting isn’t just for your investors. It’s a powerful tool for you as a founder. It shows you where your money is going, how long your runway actually is, and whether your recent hires or GTM bets are paying off. A good financial report becomes your support system. It’s the foundation you can rely on to make decisions, plan ahead, and stay in control. When you know exactly where your company stands financially, you stop reacting and start steering. That shift is what helps founders grow with intention instead of operating on guesswork.

Key Elements of Investor-Ready Financial Reporting

Let's look at the structure of these financial reports. What do investors expect?

Even early stage startups should have these 3 reports:

- Income Statement (P&L) Show how revenue, expenses, and profit (or loss) are trending. Investors want to see:

- Gross margin: Revenue left after covering direct costs of goods (product)

- Operating efficiency: How much revenue you earned for every euro spent on operations

- YoY or MoM revenue growth: How fast your revenue is increasing over time

- Balance Sheet Gives a snapshot of what the business owns and owes:

- Cash reserves: Money available in the bank today

- Liabilities: What your company owes to others

- Capital raised vs spent: How much funding you’ve secured and how much is left

- Cash Flow Statement This one matters a lot, especially at early stage:

- Cash burn rate: How much cash you’re spending each month

- Runway left (in months): How many months you can operate at current burn

- Operating vs investing cash flow: Cash used for daily operations vs future growth bets

- Bonus SaaS Metrics Key growth indicators every SaaS founder should track. They show how efficiently you acquire customers, recover costs, and retain revenue over time.

- MRR / ARR: Monthly / Annually recurring revenue. A clear view of what’s coming in on a regular basis.

- CAC, LTV: How much it costs to get a customer, and how much you earn from them over time

- Unit economics by cohort: How revenue and costs vary across different customer groups/ batches over time.

What not to do with an Investor Report

- Do not copy paste your accounting report as is. Investors don’t just want to collect documents from you, they want to know what your inference is. If you understand what is going on.

- Do not make a 20 page deck/ 50 row spreadsheet. Long reports are not helpful. Your report should be a snapshot of your financial health and give investors a clear view at a glance.

- Do not skip the summary. Include a paragraph of your commentary on: What changed this month? Why did burn increase? What’s next?

- Do not miss sending these reports as planned. Missing a month sends a bigger message than you think. Automate your reports as much as you can.

How to Create Your First Investor-Ready Report

Spreadsheets are a great start, until they’re not

We get it. Google Sheets is flexible and free. But as your metrics grow and your team scales, spreadsheets start to slow you down:

- Easy to break, hard to debug. One formula off and your runway’s wrong

- Scripts and macros are time-consuming to build, slow to run, and often unreliable

- Not built to customize or share cleanly across multiple investor formats

- Manual updates turn into a monthly chore, especially with multiple data sources

If you’re still using Excel for your investor updates, it might be time to rethink.

Skip the Spreadsheets. Automate Your Financial Reports.

If you’ve never built an investor report before, we can help.

We’re working with a handful of early-stage founders to create lean, repeatable investor reports.

[Join our beta] - and get your first report built with us.

Final Thoughts: Build Investor Confidence Through Clear Reporting

Financial reporting isn’t just about compliance. It builds trust, sharpens your decisions, and keeps you focused on what matters: managing runway, hitting milestones, and planning your next move.

Clear reports align you and your investors on where the company stands and where it’s headed.

About the author

Generalist with 12 years of experience in Tech startups in different roles like Solutions engineering, Developer Relations and a stint as a VC.